Estate Gift from IRA

Like local churches and other nonprofits, The United Methodist Foundation encourages its donors to consider making a gift to the Foundation in their estate plans. And like churches and other nonprofits, we sometimes receive an unexpected gift from a donor that the current staff didn't know.

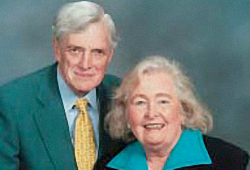

We were delighted to be the beneficiary of a portion of an IRA from the estate of Catherine Koten. Catherine and Jack Koten were long time, active Northern Illinois Conference United Methodists. Friend Sally Gill recalls that Jack "devoted his life to the church – not only locally but also at the annual conference level."

Dick Heiss, former Executive Director (ret) of The United Methodist Foundation recalls Jack's work beyond the local church as well. Jack chaired the NIC Board of Pension and Health Benefits, and he successfully spearheaded a $5M conference-wide capital campaign to address the unfunded liability in the NIC Clergy Pension Fund at that time. When the 120-year old Barrington UMC burned to the ground, he was instrumental in helping raise the funds to build a new church.

Reverend Jim Wilson fondly recalls the Catherine and Jack. In their careers, their community service and their family life, they strived to integrate principle-centered values and practices. "They wanted to do good with their money."

The Foundation is grateful for the generosity of Catherine and Jack Koten. We celebrate their lifelong ministry throughout the conference. And their gift demonstrates their trust in the future ministry and mission of the Foundation and the churches of northern Illinois.

An estate gift of a portion of one's IRA is easy to complete using a change of beneficiary form from your plan administrator. You continue to own the asset and have access to the funds throughout your life. What is left after your death is distributed to those beneficiaries you designate, including any charitable beneficiaries you name.

As always, we urge you to consult with your legal and tax advisors before completing any planned gift.